Business Valuation Topics

The Hidden Levers That Inflate Your Valuation (Without Revenue Growth)

Discover how to increase your business valuation without growing revenue. Curtis Waters reveals the hidden levers that drive high-value exits. ...more

Business Valuation

June 08, 2025•0 min read

Why 90% of SMB Owners Overvalue Their Business (And How to Fix It)

Most small business owners overvalue their company by 2x. Learn why, and how to fix it before selling or fundraising. Curtis Waters explains the truth. ...more

Business Valuation

June 08, 2025•0 min read

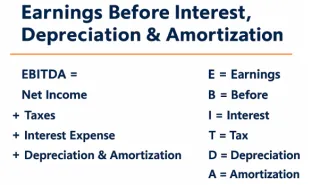

What Factors Affect Business Valuation?

What Factors Affect Business Valuation | Curtis Waters | Discussion of EBITDA, recurring revenue, assets, long term value ...more

Business Valuation

June 08, 2025•0 min read

Discounted Cash Flow (DCF): What It Is and Why It Matters

Master DCF valuation—key to raising capital, exits, and investor negotiations. Curtis Waters’ strategic guide. ...more

Business Valuation

June 08, 2025•0 min read

How to Increase EBITDA: Profit Growth Strategies That Work

New Blog Post Description ...more

Business Valuation

June 08, 2025•0 min read

Understanding Business Valuation: A Guide to Determining Value

Curtis Waters reveals proven frameworks to scale your business profitably. Learn growth strategies that attract investors and maximize valuation. Start executing today. ...more

Business Valuation

June 08, 2025•6 min read

Real Estate Investing Topics

Using Other People’s Money to Build Your Real Estate Empire

Discover how using Other People’s Money (OPM) - including hard money - accelerates real estate investing. Compare cash-on-cash , returns, leverage, and the velocity of capital vs. using your own fund... ...more

retopics

June 09, 2025•0 min read

Why You Should Use an LLC to Hold Your Rental Properties

Learn why real estate investors use LLCs to hold rental properties. Understand the benefits of limited liability, tax flexibility, and how to avoid piercing the corporate veil. ...more

retopics

June 09, 2025•0 min read

What Is a DSCR Loan? A Guide for Real Estate Investors

Learn how DSCR loans work, how to calculate your Debt Service Coverage Ratio, and why it’s a powerful tool for real estate investors looking to scale portfolios without personal income limitations. ...more

retopics

June 09, 2025•0 min read