Understanding Business Valuation: A Guide to Determining Value

“Valuation is earned through strategy, EBITDA proves it, and a smart exit makes it real.” - Curtis Waters

Introduction:

In today's dynamic world, understanding the true value of your business is crucial, especially when considering an exit strategy or planning for future growth. Determining a business's worth is not just about numbers; it's about understanding the intrinsic value created through relationships, expertise, and market presence. This article will guide you through the process of business valuation, focusing on key concepts such as EBITDA, platform growth, and exit strategies.

The Importance of Business Valuation

Business valuation is the disciplined process of determining what a company is truly worth. That includes assessing the commercial strength of its services, the measurable influence of its content, and the revenue-driving impact of its speaking engagements or authority positioning. Knowing that number isn’t optional—it’s the foundation for every intelligent move in mergers, acquisitions, and exits. It sets the benchmark for operational performance, future scalability, and investor appeal. If you can’t quantify your value, you can’t negotiate powerfully, attract capital, or exit on your terms.

Key Components of Business Valuation

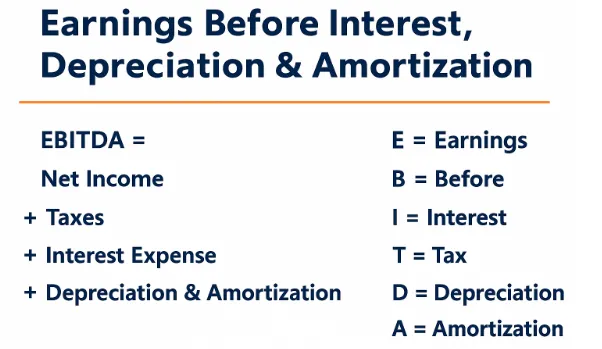

EBITDA -- A Key Metric —Earnings Before Interest, Taxes, Depreciation, and Amortization—is a core financial metric used to evaluate a company’s true operating performance. It strips away non-operational costs to reveal what the business earns from its primary activities. This means capturing the profit generated from recurring operations and projects—without the noise of financial structuring or accounting treatments. A strong EBITDA signals operational strength and scalability, positioning the company as a valuable and credible opportunity for serious investors and acquirers.

Platform Growth: Expanding Horizons

Platform growth is the deliberate scaling of a core business that serves as the foundation for future bolt-on acquisitions, operational leverage, and market dominance. In the private equity world, a “platform company” is the anchor investment—a business with solid leadership, strong EBITDA, and infrastructure that can absorb smaller complementary companies.

Growth at the platform level isn’t just about revenue. It’s about building systems, culture, and scale that can support rapid expansion. That includes geographic reach, new verticals, product extensions, and recurring revenue models. The goal: multiply enterprise value by turning the platform into a dominant player in its niche.

If the business can’t grow both organically and through acquisition, it’s not a platform. It’s just a standalone asset.

Exit Strategy: Planning for the Future

An exit strategy is not an afterthought—it’s a core part of the business plan from day one. It’s the deliberate, structured process of preparing a company for a sale, merger, or transfer of ownership with the goal of extracting maximum value at the right time, under the right terms.

For founders and shareholders, an exit isn’t just about cashing out. It’s about positioning the business so that buyers see future upside, not just past performance. That means locking in systems, strengthening EBITDA, diversifying revenue, reducing key-person risk, and clearly articulating a growth narrative that a new owner can capitalize on.

A proper exit strategy includes:

Valuation Planning – Driving EBITDA multiples by improving margins, recurring revenue, and clean financials.

Buyer Framing – Presenting the business in terms buyers care about: growth potential, defensible market position, and post-sale scalability.

Deal Structuring – Knowing when to push for a full cash-out, when to hold equity, and how to use earn-outs or seller financing to increase total deal value.

Timing the Market – Exiting when multiples are high, capital is abundant, and your sector is trending upward.

Exits are engineered, not hoped for. They reward strategic preparation, not emotional decisions.

Steps to Determine Your Business Worth

Start by conducting a thorough review of the company’s financial statements—this includes income statements, balance sheets, and cash flow reports. Focus on core indicators: revenue streams, cost of goods sold, operating expenses, and net income. These numbers reveal how the business earns, spends, and retains capital.

From there, calculate EBITDA—Earnings Before Interest, Taxes, Depreciation, and Amortization. This metric strips out non-operational and non-cash items to present a clear picture of the business’s core profitability. A strong EBITDA signals operational efficiency and provides a cleaner benchmark for comparing performance across companies in the same industry.

Next, assess the company’s historical financial performance. Look for trends in revenue growth, margin stability, customer acquisition costs, and seasonality. Identify any anomalies or one-time events that could distort true earning power.

Finally, build forward-looking projections based on realistic market conditions, competitive positioning, and internal growth capacity. Factor in industry-specific drivers, geographic expansion, new revenue channels, and potential risks. Your valuation is only as strong as the credibility of your forecast.

This isn’t guesswork—it’s disciplined financial storytelling. Buyers don’t pay for the past. They invest in the future.

Assess Market PositionCo

Evaluate the business beyond the numbers by examining strategic intangibles that drive long-term value. Begin with market share—a strong position in the industry signals dominance, pricing power, and defensibility. Buyers are drawn to businesses that lead, not follow.

Next, identify competitive advantages. These could include proprietary systems, exclusive partnerships, a loyal customer base, or barriers to entry that insulate the business from emerging threats. Sustainable differentiation is what commands a premium valuation.

Brand reputation is another key asset. It reflects trust, authority, and market perception—all of which influence client retention, pricing leverage, and referral flow. A strong brand reduces marketing costs and accelerates buyer confidence.

Together, these qualitative assets shape perception, drive deal interest, and increase enterprise value. When combined with strong financials, they transform a business from a commodity into a premium acquisition target.

Consider Intangible Assets

Beyond the balance sheet, real value lies in the intangible assets that set a business apart. These include brand equity, which reflects market trust and recognition; customer relationships, which drive repeat business and long-term revenue; intellectual property, such as trademarks, proprietary systems, or content; and industry expertise, which positions the company as a credible authority.

These elements often determine whether a business is seen as a scalable enterprise or just another commodity. While they may not appear on financial statements, they directly impact pricing power, customer loyalty, and buyer perception—all critical drivers of valuation.'

How Your Business is Valued

To ensure an accurate and unbiased valuation, engage a professional business valuator. They can provide insights into industry benchmarks, valuation methodologies, and market conditions. A professional valuation report enhances credibility and provides a solid foundation for negotiations with potential buyers or investors.

Conclusion

Business valuation is far more than a financial assessment—it’s a strategic blueprint. It requires a disciplined evaluation of financial performance, EBITDA strength, platform scalability, and market position. For a company operating in the real estate space, this clarity becomes the foundation for powerful decision-making.

Understanding the true worth of the business enables owners and stakeholders to align with long-term objectives—whether preparing for an exit, attracting capital, or accelerating growth. It frames the company not just by what it has achieved, but by where it’s positioned to go.

In a competitive and rapidly shifting real estate environment, valuation isn’t optional. It’s how you leverage your operational excellence, brand authority, and relationship capital to command respect, attract buyers, and drive enterprise value.

Know your worth. Then scale it.